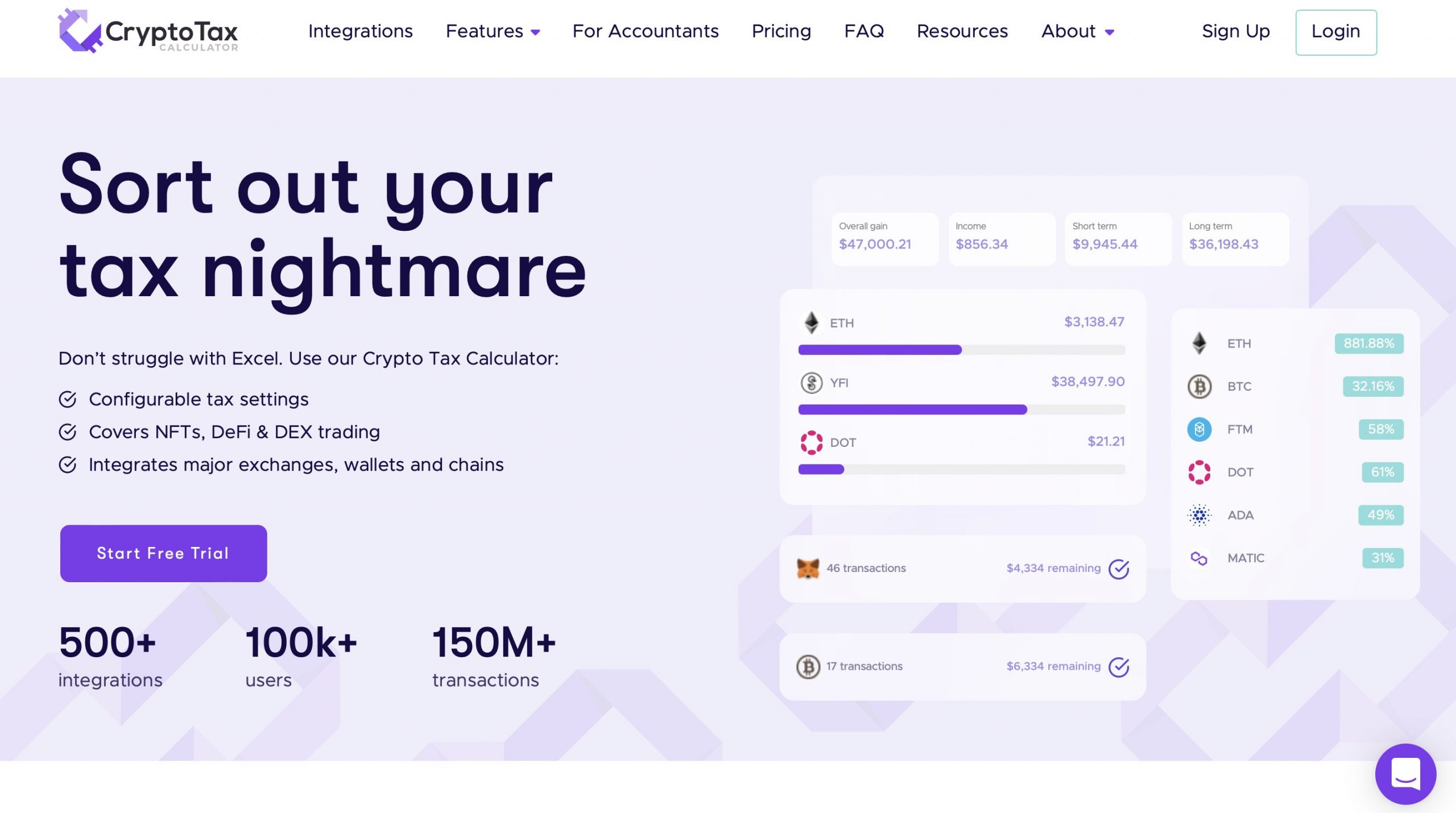

crypto tax calculator review

Although it has a 30-day free trial that supports 10000 transactions you must pay to retrieve your Form 8949 and Schedule 1. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

The company is based in Sydney Australia and was founded in 2018.

. It is possible to use it for up to 25 transactions without having to pay anything. Crypto Tax Calculator is one of the industrys top cryptocurrency and NFT tax platforms. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

CoinTracker is one of the best crypto tax software for beginners because it has a free tier. Customer service is great. It allows users to easily create well-organized and reliable crypto tax reports.

You simply import all your transaction history and export your report. Theyre quick to respond take ownership follow up and address the root cause rather than giving generic unhelpful responses. CryptoTax is a crypto tax tool that helps its users to calculate taxes and figure out the amount of taxes they need to pay.

Crypto Tax Calculators annual subscription ranges from 49 to 399 and supports up to 100000 transactions. Tax year reporting from 2013-2021 depending on what data is pulled and imported. Calculate and report your crypto tax for free now.

You can discuss tax scenarios with your accountant. The platform supports more than 100 exchanges a variety of DeFi protocols and is one of the few currently in existence accurately supporting Binance Smart Chain and NFTs. Furthermore this feature is completely free.

Amazing if you ask me. You can ensure that you dont incur the IRSs or your local tax agencys wrath in the future. 10 to 37 in 2022 depending on your federal income tax bracket.

This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. The price differences are due to elements such as the number of transactions 100 - 100k and the types of reports. I can do all the imports fix missing transactions and be comfortable everything balances before I commit to paying them for the tax summary.

These reports have a complete transaction history as well as full crypto gains and losses information. The platform offers you ten clients and up to 100000 transactions per client. CryptoTaxCalculator was created to help crypto investors in the United States Canada New Zealand United Kingdom and Australia identify which taxes they are subject to when it comes to crypto investments easily and automatically.

Use Crypto Tax Calculator. Rookie at 49 Hobbyist at 99 Investor at 189 and Trader at 299. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

Covers NFTs DeFi DEX trading. The platform was launched in Germany back in 2017. It is worth noting that The Crypto Tax Calculator offers a free-trial period 30 days as well.

Generate a tax report on Bitcointax. Congratulations youve just calculated your crypto taxes with only 2 steps. Customer service is great.

Finally go to Reports Export then choose the report that youd like to download. Calculating your tax reports. If you are an accountant you can also work with the Crypto Tax Calculator for 499year.

The main goal of the platform is to help individuals and companies in meeting their legal obligations arising from dealing with blockchain-based assets. I can do all the imports fix missing transactions and be comfortable everything balances before I commit to paying them for the tax summary. It offers a free trial that allows you to import data review transactions see a full.

Go to the Calculate tab and choose your tax year then click on Calculate. We always recommend you work with your accountant to review your records. With its easy-to-use tax tools Crypto Tax Calculator can shave hours off time dedicated to doing crypto and NFT taxes and potentially lower your overall tax burden.

Crypto Tax Calculator is a software tool allowing users to calculate taxes on virtual currency trading activity. The pricing tiers and their yearly costs include. Furthermore this software keeps track of your portfolios performance and assists you in managing it to maximize your profits.

If you would like your accountant to help reconcile. Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years starting from 2013. Integrates major exchanges wallets chains.

IRS Form 8949 TurboTax Support. Straightforward UI which you get your crypto taxes done in seconds at no cost. All plans have a 30-day money-back guarantee.

Theyre quick to respond take ownership follow up and address the root cause rather than giving generic unhelpful responses. Founder Shane Brunette devised Crypto Tax Calculator after.

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Cryptotrader Tax Cryptocurrency Tax Calculator Tax Software How To Be Outgoing Tax

Capital Gains Tax Calculator Ey Us

The Ultimate Crypto Tax Guide 2020 Cryptotrader Tax In 2021 Cryptocurrency Trading Tax Guide Cryptocurrency

Crypto Tax Calculator Overview Youtube

Gosimpletax Hmrc Tax Calculator Self Assessment In 2021 Self Assessment Finance Apps Assessment

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

11 Best Crypto Tax Calculators To Check Out

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out